The NBA is closing in on a historic media rights deal, and it could have significant team-building implications for the Brooklyn Nets. Just days ahead of the 2024 NBA Finals, the league is nearing a contract with NBC, ESPN, and Amazon worth nearly $76 billion over 11 years, according to the Wall Street Journal. It would kick in at the start of the 2025-26 season.

The Nets have positioned themselves to have maximum cap flexibility during the 2025 offseason, turning down numerous trade inquiries for Mikal Bridges in the process. They've done so with an eye on the league's looming revenue boom. The money from the new TV deal gets factored into basketball-related income, which determines the salary cap each season. When the new deal begins, the cap will steadily increase in the coming years, starting in 2025-26.

The Golden State Warriors used a historic $24 million cap spike (a 34 percent increase from the prior season) to sign Kevin Durant in 2016. Brooklyn won't benefit from that type of jump, with the new collective bargaining agreement preventing the cap from rising by more than 10 percent from one season to the next.

However, with the 2024-25 cap set at $141 million, a 10 percent increase would raise the 2025-26 cap to $155 million. That's nearly triple the jump the league will see this offseason. The 2023-24 cap, previously set at $136 million, will increase only 3.7 percent ($5 million).

Why the Nets are gearing up for a loud 2025 offseason

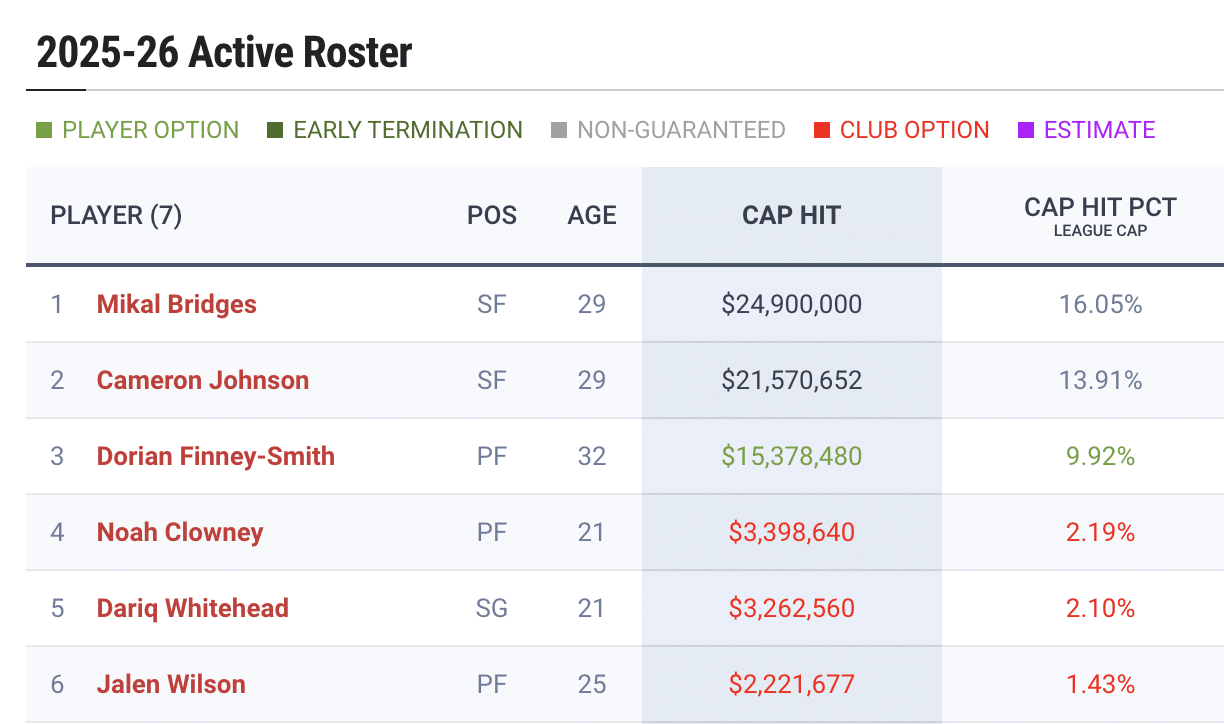

With Ben Simmons' five-year, $177 million contract expiring after the 2024-25 campaign, the Nets have just five players on their payroll in 2025-26: Mikal Bridges, Cam Johnson, Noah Clowney, Dariq Whitehead, and Jalen Wilson.

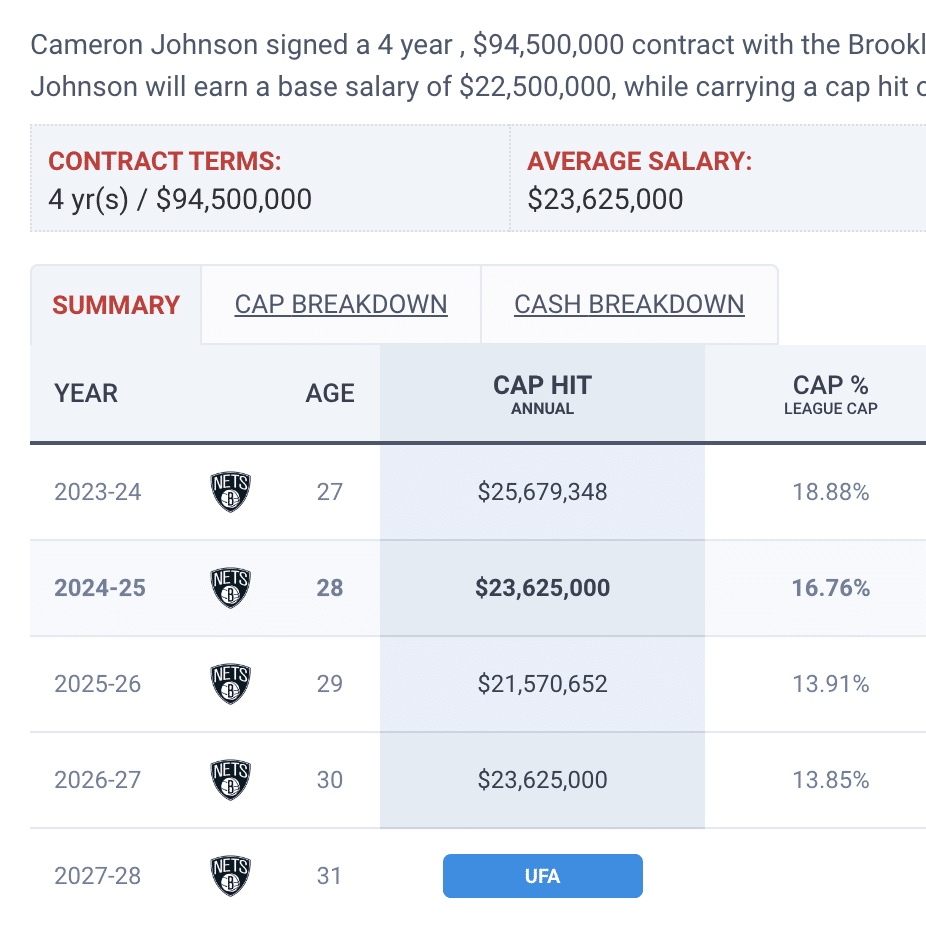

That number should increase to six this summer, with the team expected to re-sign Nic Claxton. Brooklyn structured Cam Johnson's four-year, $94.5 million contract last summer to ensure his lowest cap hit would come in 2025-26, maximizing their space next offseason. There's a good chance they'll do the same with Claxton on a similar-sized deal should he return to the Nets.

The Nets must decide on potential extensions for Cam Thomas and Day'Ron Sharpe, who will be restricted free agents next summer. There are also rumblings that they will explore trading Dorian Finney-Smith, who has a $15.4 million player option in 2025-26, for an expiring contract and draft compensation this summer. Depending on those decisions, Brooklyn could open up nearly $80 million in cap space next offseason.

However, in today's landscape, NBA stars rarely change teams via free agency. The last significant example came in 2019 when the Nets signed Kevin Durant and Kyrie Irving using two max slots. This is why many expect Brooklyn to aggressively pursue Donovan Mitchell via trade this summer if he declines to sign an extension with the Cleveland Cavaliers.

But with Bridges, Claxton, Johnson and Clowney under contract, plus a boatload of cap space and seven tradable first-round picks to make subsequent moves, Brooklyn could have a very intriguing pitch if a marquee name hits the market in 2025. Among the stars whose deals expire next summer are Mitchell, Irving, Jayson Tatum, Jalen Brunson, Lauri Markkanen, Jimmy Butler, Paul George, Jamal Murray, Brandon Ingram, and Alperen Sengun.

If all of those names extend with their current teams, several high-level role players also have expiring deals, including Derrick White, Rudy Gobert, Aaron Gordon, Myles Turner, Naz Reid, Jonathan Isaac, Julius Randle and D'Angelo Russell. The Nets could pursue several players in this group and then use their draft assets to search for a star via trade.

General manager Sean Marks pointed to Brooklyn's draft assets and 2025 cap space, along with the allure of the New York market, when asked about attracting stars in the future.

“We have to show [stars] there's a pathway to win here. I think there’s a very clear pathway from draft assets, cap room, and everything else we’ve got,” Marks said at the All-Star break. “And I think this city speaks for itself. It’s been very clear that people have wanted to come here and play in the past.”

Sean Marks on whether attracting stars was a main factor in making a coaching change:

"We’ve gotta show them there’s a pathway to win here. I think there’s a very clear pathway from draft assets, cap room, and everything else we’ve got… And I think this city speaks for itself.… pic.twitter.com/e54Wd96FaU

— Erik Slater (@erikslater_) February 20, 2024

What would this plan mean for Nets in the 2024-25 campaign?

Following a 32-50 campaign, the Nets will have limited avenues to improve their roster this summer outside of a significant trade. Brooklyn will have the $12.9 million non-taxpayer midlevel and $4.7 million biannual exceptions to use in free agency. However, they will avoid the luxury tax to reset a CBA clause known as the repeater tax.

If the Nets re-sign Claxton, they should have roughly $15 million in space below the tax line to fill three roster spots. They're unlikely to find a player who moves the needle in that range. And outside of Mitchell, it's unclear if another marquee name would be available to pursue via trade.

After firing Jacque Vaughn at this year's All-Star break, Brooklyn hopes newly-hired head coach Jordi Fernandez can produce better results with a similar core next season. But barring a trade or an abrupt pivot to a reset, the 2024-25 season could be another audition year for the Nets to decide which players will remain in the picture when they take their big swing next summer.