Once a prominent figure in Barcelona's midfield, Arda Turan finds himself embroiled in legal troubles as he receives a one-year prison sentence for tax fraud in Spain. The conviction, relating to offenses committed in 2015 and 2016, comes with a hefty fine of €630,000, reflecting the severity of the charges against the former Turkish international.

Turan's journey from Atletico Madrid to Barcelona was marked by promise and potential, with the midfielder making significant contributions to the Catalan club's success during his tenure. However, his subsequent loan spells and eventual retirement from Galatasaray in 2022 now stand overshadowed by the stain of tax fraud allegations.

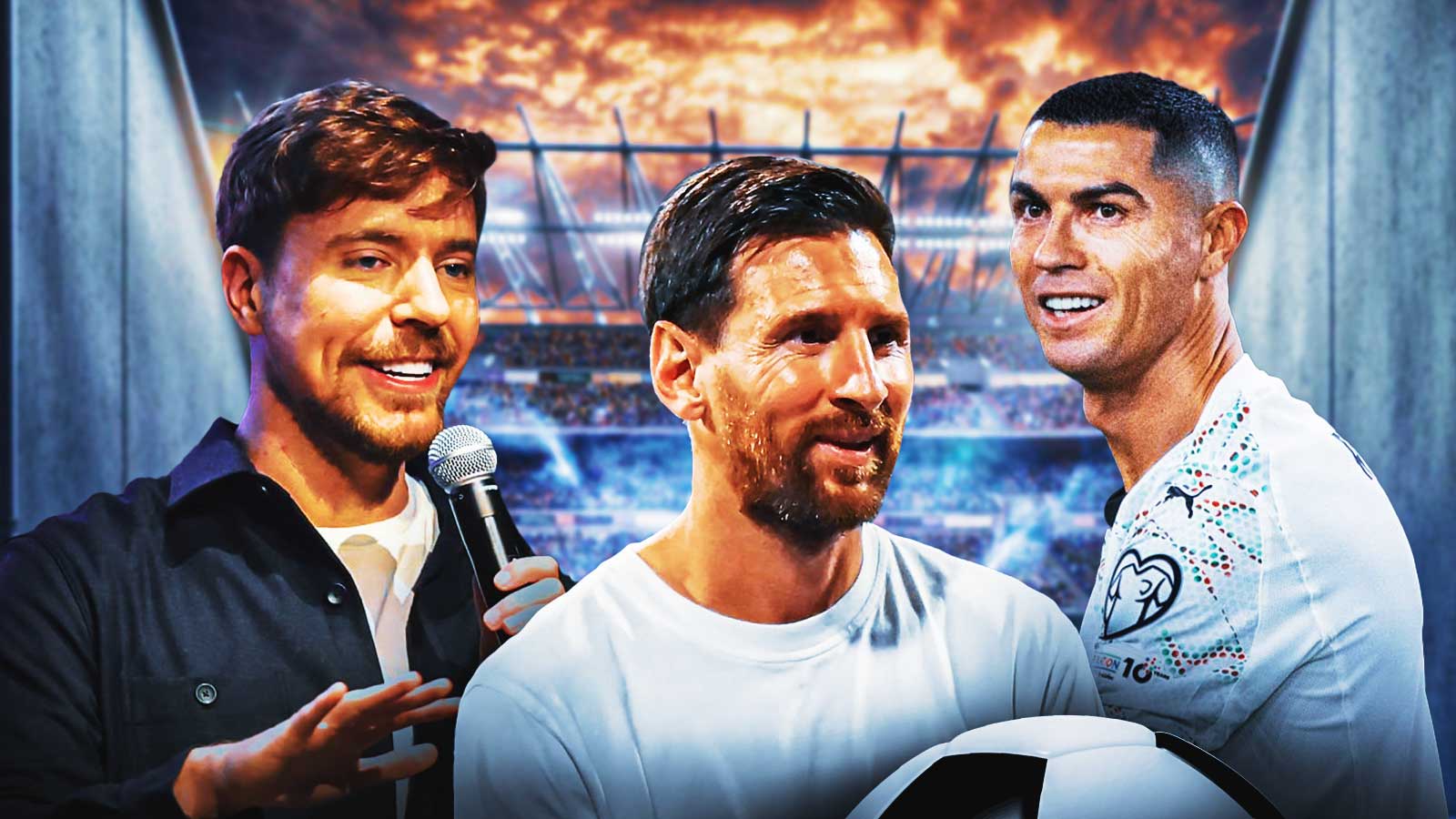

The case against Turan underscores a broader trend of legal challenges high-profile footballers face regarding tax obligations. In recent years, Spanish tax authorities have targeted numerous stars of the sport, including Lionel Messi, Cristiano Ronaldo, and Jose Mourinho, for alleged tax evasion or fraud. Despite the severity of the accusations, few have faced actual prison time, with suspended sentences and fines being more common outcomes.

The scrutiny faced by athletes regarding their financial affairs has become increasingly intense, with Spanish authorities cracking down on instances of financial misconduct within the sports industry. Turan's conviction is a stark reminder of the consequences of failing to meet tax obligations, even for players accustomed to the limelight and adulation of the football world.

While this legal episode may mar Turan's career, the broader implications extend beyond his case. The footballing community continues to grapple with the complexities of managing financial responsibilities amidst lucrative contracts and endorsements. As players navigate these challenges, ensuring compliance with tax laws remains critical to maintaining integrity within the sport.