The Chicago Cubs entered the 2025 MLB trade deadline in a precarious spot—competitive enough to chase the NL Central, but not dominant enough to risk long-term assets. That context shaped the front office's calculated decision to avoid blockbuster moves for a frontline starting pitcher.

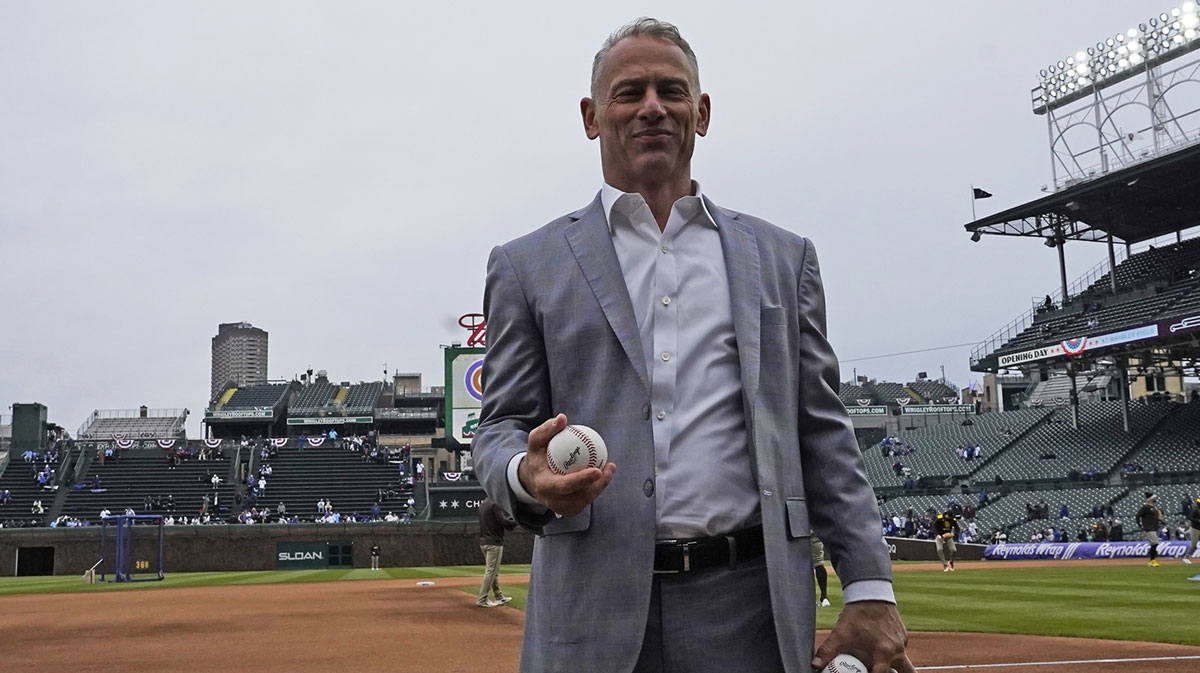

The Cubs trade deadline strategy became a hot topic after president of baseball operations Jed Hoyer addressed reporters on Thursday. He outlined the reasons behind the team’s restraint, and his remarks gained traction following a post by ESPN’s Jesse Rogers.

Rogers took to his X account (formerly known as Twitter) and shared a quote from Hoyer on why the team did not go all in at the 2025 trade deadline.

“From a SP standpoint, it was a really tight market. Very few rental starters. Of the marquee controllable starters, none of them changed hands. We didn’t acquire them but no one else did either. We felt the asking price was something we couldn’t do to the future.”

Chicago had been linked to starting pitcher Merrill Kelly, but Hoyer declined to confirm any specific targets. Rogers also noted on the platform that he refused to elaborate on why the team didn’t pursue Kelly as a rental option.

“Sometimes you line up with teams and sometimes you don't.”

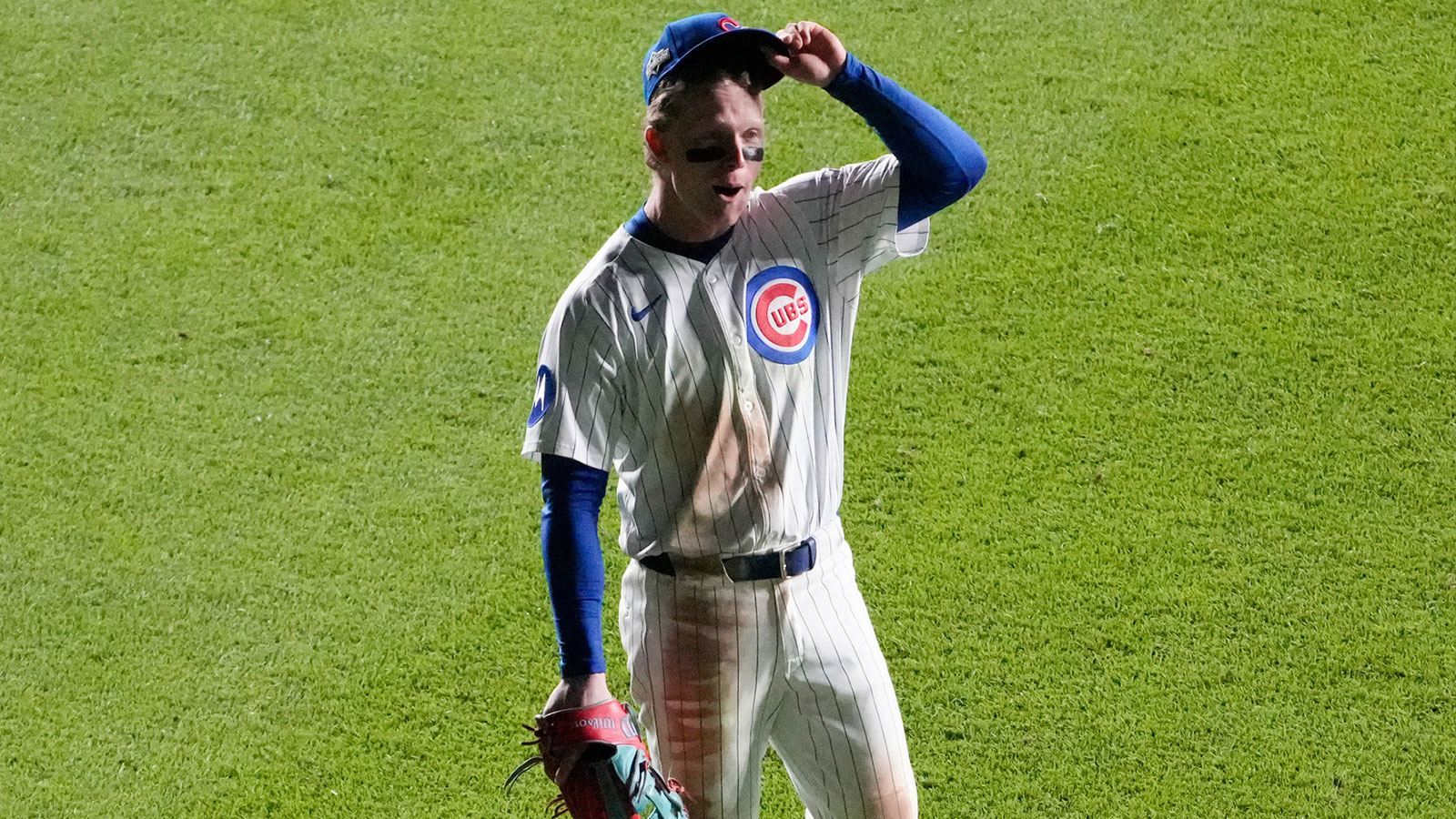

Despite trailing the Milwaukee Brewers by just one game in the race for the NL Central title, the team selected long-term sustainability over short-term risk. At 63-45, the Cubs boast a strong 33-19 record at Wrigley Field and remain firmly in the playoff mix. However, a 10-10 record over their last 20 games, including a 4-6 slide in their last 10, has sparked valid concerns about the Cubs’ momentum heading into August.

The market reality backed up Hoyer’s caution. No top-tier controllable arms, like MacKenzie Gore or Garrett Crochet, were moved at the deadline. Instead, the Cubs opted for lower-cost depth additions such as Andrew Kittredge, Taylor Rogers, Michael Soroka, and utility man Willi Castro—reinforcing an approach focused on value without overreach.

While Cubs leadership remains under scrutiny, the decision to avoid mortgaging the farm system for a marginal rotation upgrade may ultimately prove wise. As Hoyer noted, the asking prices were steep—and several other contenders made similar choices to stand firm.

While some fans hoped for a bolder move—especially after the Cubs' strong start at 36-20 through the beginning of June—the front office has prioritized the long-term picture. They're still firmly in the hunt, but not at the expense of 2026 and beyond.

In the end, the Cubs resisted pressure to make a splash. Instead, they bet on internal improvement and market discipline—setting up an intense finish to the regular season without sacrificing their future flexibility.