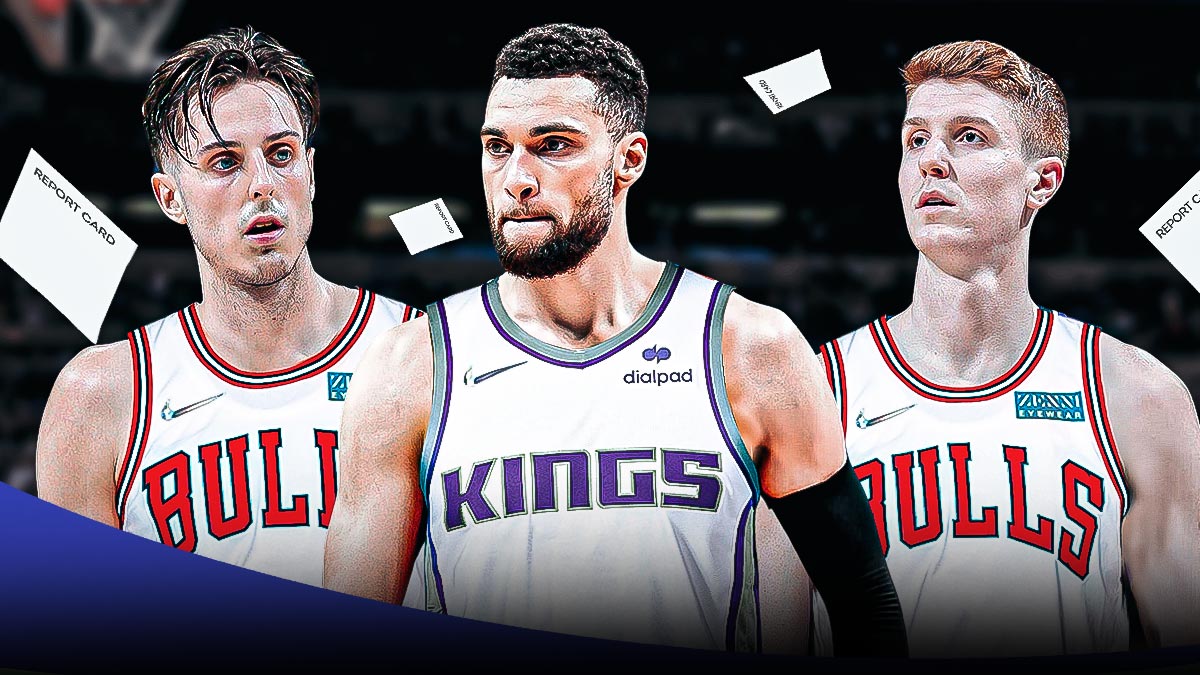

The Chicago Bulls finally pulled on the trigger on a trade that ended Zach LaVine's seven-and-a-half-year stint in the Windy City. LaVine has been involved in so many trade rumors that it wasn't clear if he was ever going to be moved, but on Sunday, the Bulls decided that his time was up and that he will be heading to the Sacramento Kings — the team that tried to secure his services when he was a restricted free agent in 2018 and expressed interest in him yet again in 2022.

The Bulls found themselves involved in the Kings' De'Aaron Fox drama; Sacramento is trying to remain semi-competitive even with Fox requesting a trade not even a week ago, and LaVine would help them in that regard. One added bonus to this is that the Kings are also reuniting LaVine with DeMar DeRozan, and when given the right pieces around them, they can certainly produce some winning basketball.

But for the Bulls' side of the equation, it was always going to be tough getting a ton of value for LaVine. His contract may not be one of the worst in the league, but considering the current salary cap/CBA context, adding someone who's set to make around $94 million over the next two seasons after this current one is not an easy investment to make. The Kings needed someone who could help keep them afloat, making them a logical trade destination, but in the end, Chicago may have sacrificed in terms of the maximum they could have gotten in the deal.

With all that said, here is an assessment of how the Bulls came out of the LaVine trade.

Bulls receive substandard trade return for Zach LaVine

Bulls traded: Zach LaVine

Bulls received: Tre Jones, Zach Collins, Kevin Huerter, CHI's 2025 first-round pick (via SAS)

This essentially works out as a salary dump of sorts for the Bulls — which may not be the ideal return for a player who's been as productive as Zach LaVine has this season. They made the trade with the intention of re-acquiring their first-round pick from the San Antonio Spurs, and perhaps that could turn out to be a valuable asset, especially when they have obligations to convey the pick in the next two seasons (protections drop to top-eight in both 2026 and 2027).

With the Bulls going more all-in on their rebuilding process, however, it's fair to wonder if they ever needed to re-acquire that pick in the first place. Perhaps the front office is envisioning a quick turnaround or that they would be staying semi-competitive for the next few years, but they are so far off from contending that it's not a stretch to think that their pick could land within those protected bounds in the next few years.

And for them to trade LaVine, one of their best trade assets, of all people just to get that pick back is a bit confusing to say the least. It still speaks to a lack of general direction from the Bulls from a roster-building standpoint, and it's not as though the players they got in return move the needle in any capacity.

Perhaps the Bulls become more inclined to trade away Nikola Vucevic now that they have Zach Collins on the roster. But as far as repercussions go, that's as impactful as Collins, Tre Jones, and Kevin Huerter are going to get. Jones is a capable backup point guard, but with Coby White, Lonzo Ball, and Josh Giddey on the roster, it's not as though they needed another ballhandler.

Huerter is a good depth piece, but he's been declining over the past two seasons. He's nothing more than a bench player or trade fodder for the Bulls, and it's not like other teams will be lining up for his services.

Just to top it all off, it's not as if the Bulls cleared cap space with their maneuver. Sure, they're no longer on the hook for LaVine's contract that will run until 2027, but Collins and Huerter will be on their books through next season anyway. Only Jones' contract is expiring, so there are still huge contracts on the Bulls' payroll even with LaVine on his way to Sacramento.

Simply put, this is a disappointing return for a 24-points per game scorer who's bounced back from an injury-ravaged 2023-24 season. Perhaps this is more indicative of how LaVine's trade value actually is when factoring in his huge contract. But the overall sense is that the Bulls have once again sold low on another one of their most valuable assets.

Bulls' trade grade: D