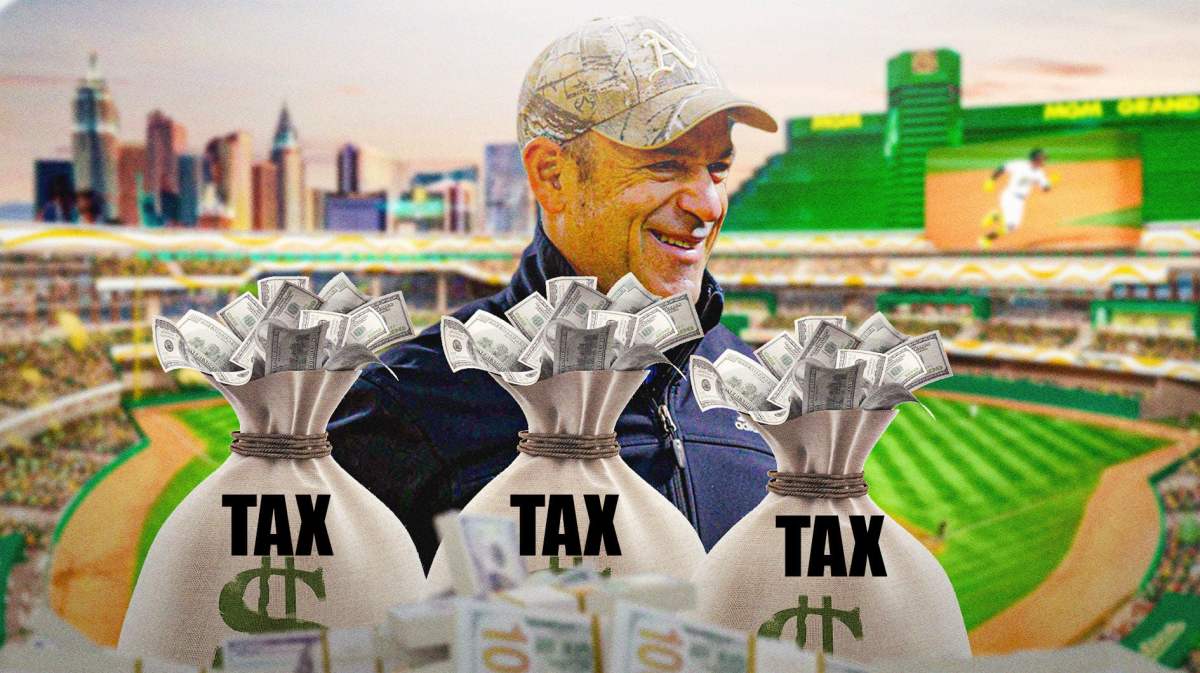

The owner of the Oakland-soon to be Las Vegas-Athletics is staring down a troubling proposition. The Athletics owner John Fisher could be hit with a large tax penalty if he decides to sell the team amid its move to Las Vegas, Nevada. Fisher must hold on to the team until 2034 unless he wishes to pay taxes to Major League Baseball owners, per the USA Today.

Fisher would be subject to something called the 10-year flip tax if he decides to sell the team before then. According to this policy, the owner would have to pay a percentage in tax to the other owners in the league if the team is sold within a ten year window from when a franchise move is approved. The Athletics were approved to move to Las Vegas this past week. Oakland had fought to try and keep the team in the city.

Major League Baseball gave Fisher about a $300 million break by not charging him a relocation fee, per USA Today. But if he tries to sell the team soon, he’s going to have to pay a stiff penalty. The agreement with the MLB owners requires Fisher to hold on to the Athletics until at least 2028 when they are scheduled to open in Las Vegas, unless he wants to pay a heavy price. If Fisher sells before 2028, he will be taxed 20% of the purchase price, which will be split among the other owners.

That number then decreases. If Fisher sells in 2029, he will be taxed 10%. That number continues to decline each year through 2033, per USA Today. He will be unable to sell the team without being taxed at all until 2034.

Time will tell if Fisher is going to hold on to the Athletics and what price he might have to pay if he does decide to drop the team. Oakland finished 50-112 in 2023, and had the worst record in the American League.