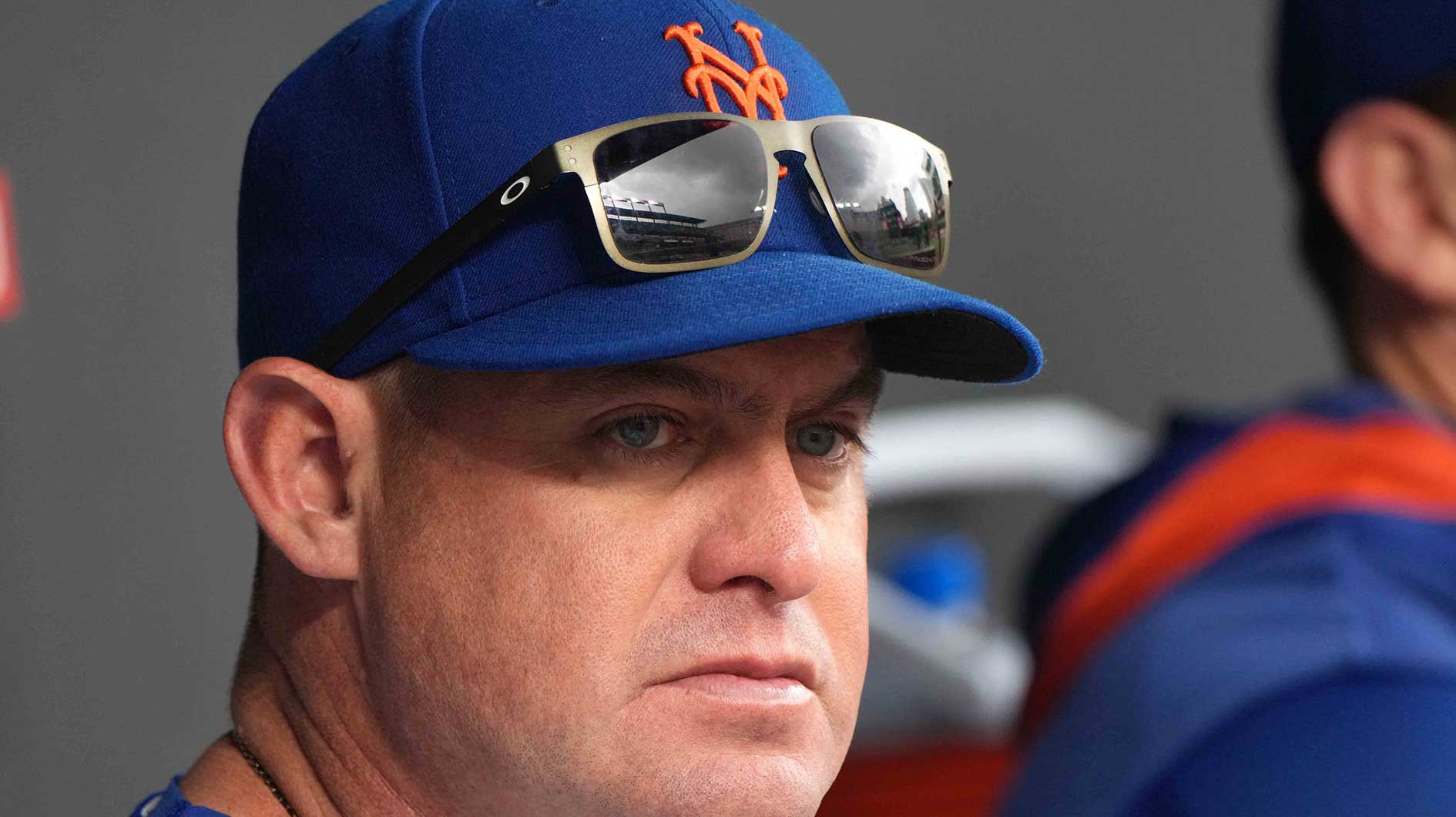

New York Mets owner Steve Cohen's hedge fund helped bail out Melvin Capital amid all the stock drama involving GameStop and Reddit.

The GameStop fiasco first began when the Reddit community discovered investors where shorting stocks. Certain Redditors responded by buying stock to prevent the price from falling further and investors capitalizing off the shorting.

But Cohen was quick to act, per RADIO.com:

New owner Steve Cohen’s hedge fund, Point72 Asset Management, invested $750 million alongside a $2 billion investment from Citadel into Melvin Capital – which held a short position on the GameStop stock and suffered huge losses before closing out of the stock by Wednesday morning.

The news elicited all sorts of reactions, and GameStop was trending on Twitter Tuesday evening. Cohen, ever the outspoken Twitter presence, issued a statement of his own:

Rough crowd on Twitter tonight.Hey stock jockeys keep bringing it

— Steven Cohen (@StevenACohen2) January 27, 2021

However, the Mets owner also assured fans the bailout would not impact payroll, though New Yorkers have reason to be skeptical considering the Wilpon family's involvement in the Bernie Madoff Ponzi scheme:

Why would one have anything to do with the other

— Steven Cohen (@StevenACohen2) January 27, 2021

Cohen's absurd wealth made him one of the notable storylines in 2020 when he purchased the Mets from the Wilpon family.

The Long Island native set the tone with his introductory press conference, stating the Mets would act like a big-market team and invest heavily both in the big-league club and the organizational pipeline.

New York has had a big impact on the market this offseason. The Mets signed catcher James McCann and right-handed reliever Trevor May before making a blockbuster deal to acquire megastar shortstop Francisco Lindor and right-hander Carlos Carrasco from the Cleveland Indians. It does not appear Sandy Alderson and Co. are done, either, as the Mets have been linked to Trevor Bauer and other notable free agents.

New York is trying to get back into the playoffs for the first time since 2017.