The Boston Celtics’ record-setting $6.1 billion sale to William Chisholm is expected to close late next week or early the following week, according to a recent report by Sportico. Three people familiar with the details, who were not authorized to speak publicly, said the deal is nearing its final stage.

The transaction still requires approval from the NBA’s Board of Governors, which is composed of the league’s 30 team owners. The vote can be conducted remotely and does not require a formal meeting.

In March, Chisholm’s group reached an agreement to purchase the Celtics in two stages, aligning with the ownership transition plan set by the Grousbeck family. The first payment valued the franchise at $6.1 billion, setting a record for the most expensive control sale in sports history at the time. That surpassed the $6.05 billion paid by Josh Harris for the NFL’s Washington Commanders in 2023 and topped the NBA’s previous record set by Mat Ishbia’s $4 billion purchase of the Phoenix Suns in 2022. In June, Mark Walter reached an agreement to purchase the Los Angeles Lakers at a $10 billion valuation, which now stands as the largest franchise valuation in NBA history.

The Grousbeck-led group originally bought the Celtics in 2002 for $360 million. Last July, less than two weeks after the team captured its NBA-record 18th championship, the group announced the franchise was for sale. Estate planning within the Grousbeck family was cited as the primary reason.

William Chisholm set to lead Celtics ownership group as team restructures roster and payroll

Chisholm, co-founder and managing partner of private equity firm STG Partners, will be the Celtics’ lead investor and take over as NBA governor from Wyc Grousbeck after the 2027-28 season. Aditya Mittal will serve as the second-largest stakeholder and may become the alternate governor in the future. Mittal is the son of Lakshmi Mittal, executive chairman of ArcelorMittal, the world’s second-largest steel and mining company by revenue.

Private equity firm Sixth Street will also hold a significant stake in the Celtics. The firm, which already owns a share of the San Antonio Spurs, will remain within the NBA’s 20% ownership cap for a single private equity firm.

BDT & MSD Partners and JPMorgan Chase co-led the Celtics’ sale process. The NBA, along with both financial firms, declined to comment on the exact timing of the closing.

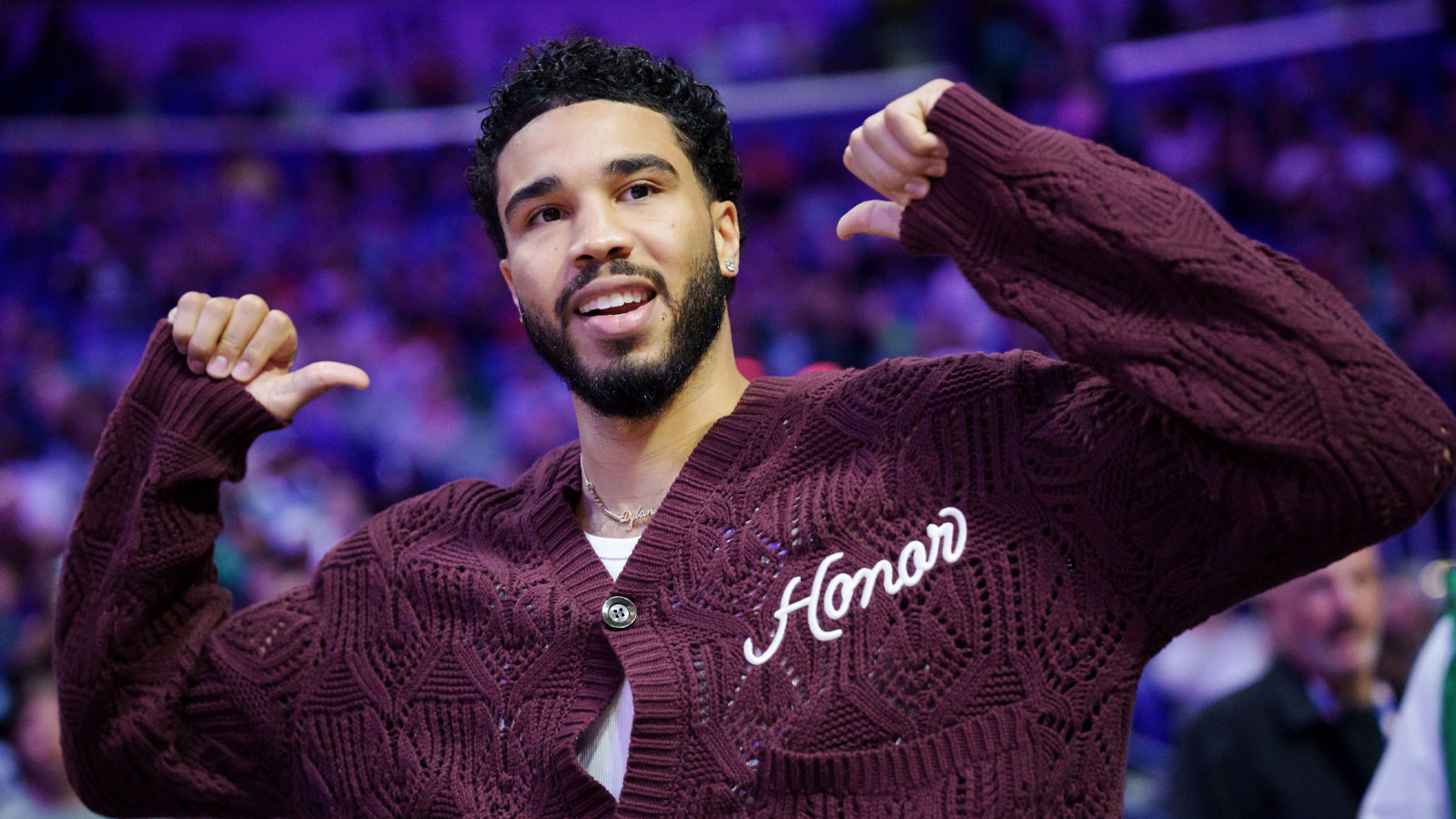

While the sale nears completion, the Celtics are preparing for the 2025-26 season with roster and payroll adjustments. Star forward Jayson Tatum continues to recover from a torn Achilles suffered during the team’s second-round playoff loss to the New York Knicks.

Boston has significantly reduced its payroll from $540 million in June to $239 million following several key trades. The team dealt Jrue Holiday to the Portland Trail Blazers in exchange for Anfernee Simons, sent Kristaps Porzingis to the Atlanta Hawks for Georges Niang and a second-round pick, and later packaged Niang with two second-round picks to acquire RJ Luis Jr from the Utah Jazz. The moves created enough financial flexibility for the Celtics to sign Chris Boucher to a one-year, $3.3 million contract on Monday, keeping them under the NBA’s second-apron tax threshold.