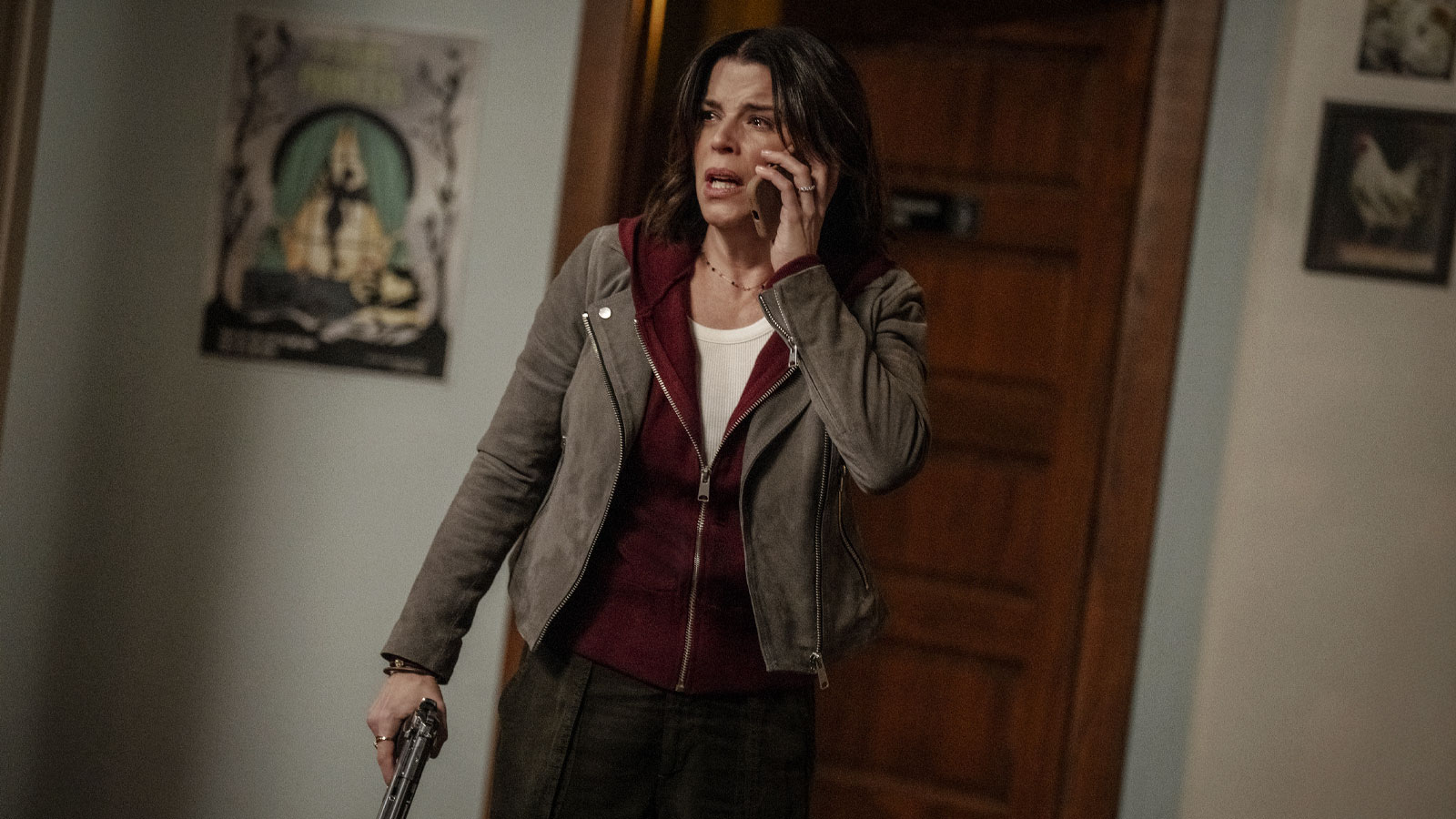

Two powerhouses might be becoming one as Paramount and Skydance could merge.

It's taking shape because David Ellison, CEO of Skydance Media, has discussed merging, Bloomberg reports. Ellison is a 41-year-old mogul in media who's looking at this opportunity to purchase one of the biggest studios around.

Paramount and Skydance in potential merger

As of now, he's made an offer to purchase National Amusements Inc., the Redstone family's holding company. It would be a way to have control over Paramount Global.

Both companies have hired advisers to look into the possible merger.

With movie theater ownership and 77% control of Paramount's voting stock, National Amusements is a big step in the right direction for a merger. Skydance will help finance a deal via Ellison's father, Larry, who founded Oracle Corp.

What's not known is if this merger will definitely take place. Hence, the advisors were hired to look into everything. Details could come about that might derail it all. Plus, it's complicated. A deal would be subject to litigation, considering its unique structure. It's an attempt from Ellison to buy out Paramount's controlling shareholders.

Also, if this goes through, Paramount+'s future could be in jeopardy.

Paramount and Skydance are now discussing a potential merger.

(Source: https://t.co/858wDVs9W6) pic.twitter.com/Rg00sfztX2

— DiscussingFilm (@DiscussingFilm) January 25, 2024

This is a major deal. Redstone's company's assets are part of a 101-year-old business. It's produced blockbuster hits like The Godfather, Top Gun, and many other classics.

Considering Paramount's share price has dropped significantly and its streamer is losing money, it could impact it all. Paramount is valued at $9 billion and Skydance is valued at $4 billion.

We'll see what happens as merge details start to emerge.