The Minnesota Twins are at the center of MLB intrigue as reports confirm a partial sale is imminent—a move that will reshape the franchise’s financial future. The transaction, combined with aggressive debt reduction and a rising franchise valuation, has emerged as a strategic pivot rather than a full transfer of control.

The Twins are nearing the completion of a deal that would sell more than 20 percent of the franchise to multiple minority investor groups. The transaction would value the organization at approximately $1.75 billion and allow the Pohlad family to retain majority ownership. The structure reflects a calculated effort to stabilize operations while positioning the Twins for a stronger long-term outlook.

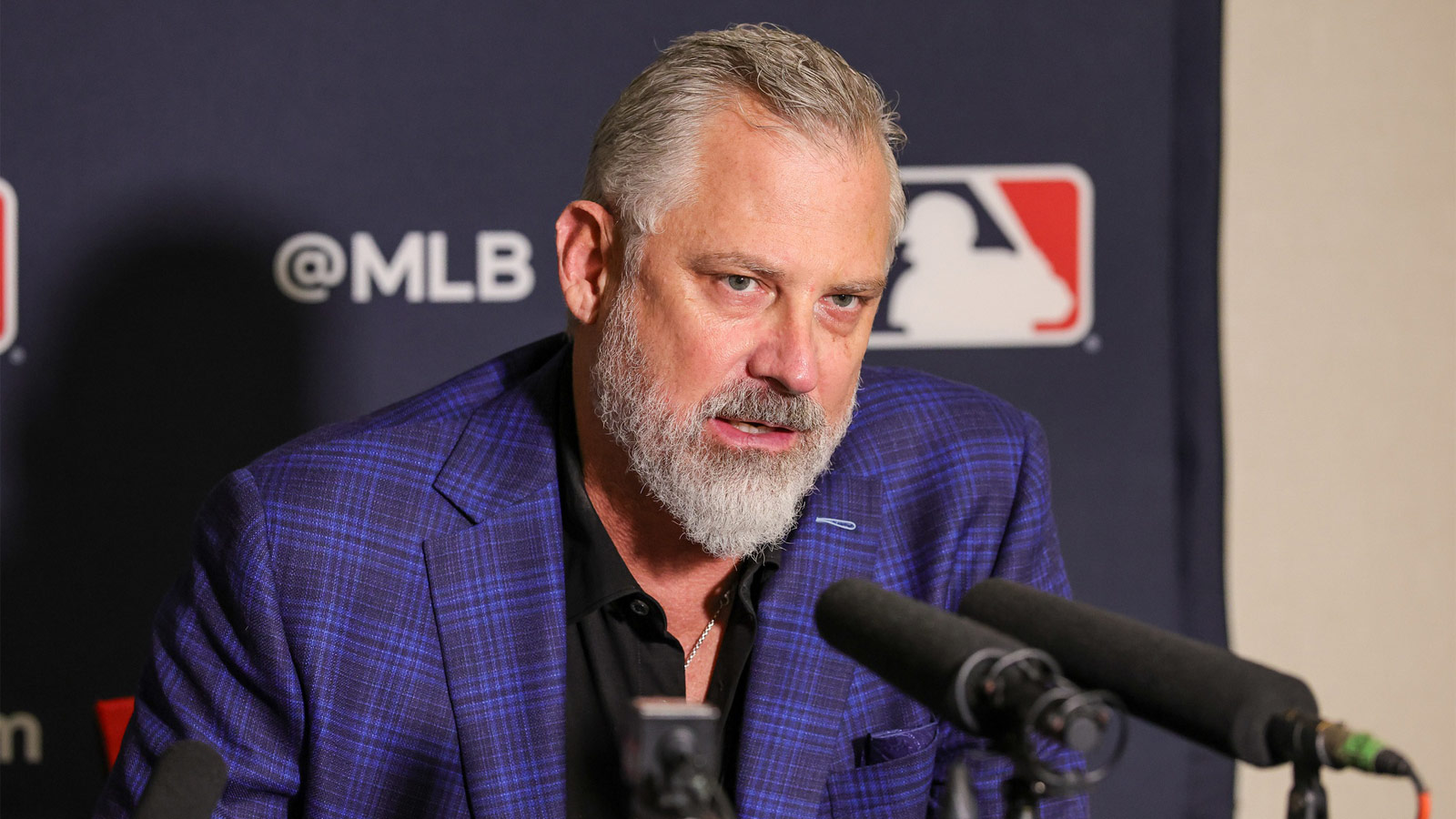

In a recent article, The Athletic’s Dan Hayes detailed why ownership believes acting now could ultimately result in a far more lucrative outcome. According to sources, the Twins’ partial sale is designed primarily to eliminate a heavy debt burden that accumulated following the 2019 season and worsened during the COVID-19 pandemic.

“It’s baked into the deal that there’ll be a meaningful, significant pay down of the debt,” one source told Hayes.

Twins debt reduction sits at the core of the franchise’s offseason strategy. By clearing nearly $500 million in obligations, ownership aims to restore financial flexibility and reset the club’s balance sheet. Doing so could make the Twins significantly more attractive to future buyers once league revenues stabilize and new media rights deals come into focus.

Hayes also noted that on-field success failed to translate into lasting financial momentum, further complicating the franchise’s outlook until now.

“They never got the boost out of (winning in 2019) because of COVID. That’s when the debt came on. It never came off. Now, it’s going to come off.”

With Twins ownership rumors continuing to swirl, the partial sale may ultimately serve as a bridge to a full transaction later this decade. If the strategy succeeds, the Twins’ franchise valuation could rise significantly once debt is removed and long-term uncertainty fades.