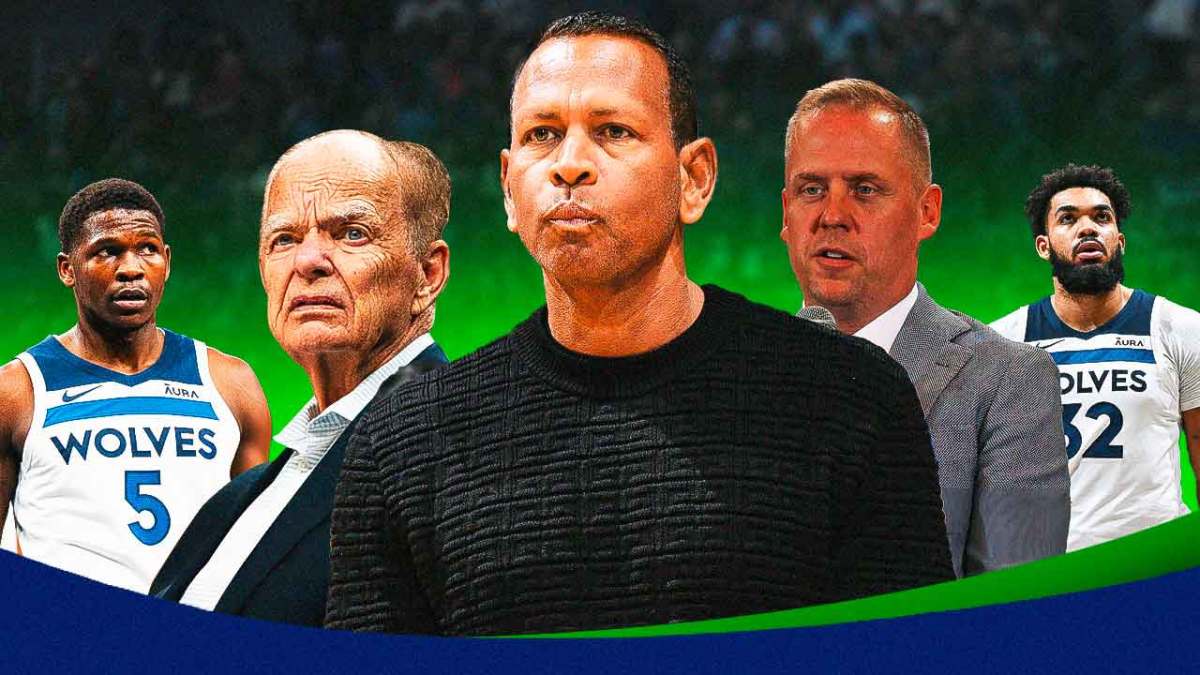

So much for their perceived willingness to pay luxury tax making Alex Rodriguez and Marc Lore the preferred owners of the Minnesota Timberwolves. As the pair continues a contentious legal battle over future stewardship of the franchise with longtime owner Glen Taylor, ESPN's Adrian Wojnarowski reported that Taylor backed out of the sides' previously agreed-upon deal in part due to Rodriguez and Lore submitting financial projections that would require the team to shed a sizable amount of salary in 2024-25.

“In documents shared with Taylor, the NBA and The Carlyle Group, a private equity firm, Lore and Rodriguez rendered a budget projection as potential majority owners that would've lowered the Timberwolves' payroll to $171 million beginning next season — below the projected $172 million luxury tax threshold, sources told ESPN. The Timberwolves would've gone from approximately a $25 million-plus tax payment to a team receiving a tax distribution of approximately $6.5 million.”

Minnesota's inevitable fiscal cliff for next season is no secret.

The Timberwolves are currently committed to paying approximately $186 million in salary to just nine players in 2024-25, according to Spotrac, not only blowing them past the initial luxury tax threshold, but also the onerous second apron once the roster is filled out in full. Teams that exceed the rough $189 million second apron are subject to higher payouts to non-taxpaying teams as well as additional restrictions on roster-building.

The hope among Minnesota fans and league followers was that Rodriguez and Lore—who greenlit the trade for Rudy Gobert as well as contract extensions for Jaden McDaniels and Mike Conley—would be more amenable to paying massive luxury tax bills going forward than Taylor, who's only paid the tax in four seasons of his nearly 30 years as majority owner. Instead, ESPN's reporting suggests the Wolves' championship-contending status quo is more likely to be maintained under the continued ownership of Taylor.

Rodriguez and Lore entered into an agreement to purchase the Timberwolves and WNBA's Minnesota Lynx from for $1.5 billion Taylor in installments in 2021. They've been integral to the franchise's decision-making ever since, serving a similar role as public-facing owners to the one Taylor typically does from his courtside seat at Target Center.

However, the 82-year-old billionaire backed out of his deal with Rodriguez and Lore in late March, alleging that they missed required deadlines for payment and were more concerned with the glitz and glamor of professional sports ownership than putting a winning product on the floor. Taylor also publicly expressed his willingness to remain owner of Minnesota as the team enjoys its most successful era since Kevin Garnett's heyday in the early-to-mid 2000s.

Rodriguez and Lore, who have respective net worths of approximately $350 million and $3.3 billion, have vehemently pushed back on Taylor's comments, suggesting he has seller's remorse as the value of the Timberwolves and Lynx has skyrocketed since their initial agreement. The NBA has reportedly advised both sides to refrain from further commentary on the matter until it is resolved by third-party or league arbitrators.

Karl-Anthony Towns' future hangs in balance of Timberwolves' ownership drama

Again, nothing about Minnesota's future salary situation is surprising. The front office made its bed in that regard by signing McDaniels to a market-rate five-year, $136 million extension last fall despite the contracts of Gobert, Anthony Edwards and Karl-Anthony Towns already being on the books. New deals for Naz Reid and Conley only furthered the team's existing financial commitments.

The Wolves' surest means of avoiding the second apron and potentially the tax altogether next season has always been obvious. After Gobert's disappointing debut season in Minneapolis, there was even a common assumption among league insiders that parting ways with Towns—expected to net a much greater return via trade than his fellow seven-footer—was Minnesota's best path forward from both financial and on-court perspectives.

What a difference a season makes. Not only is a rejuvenated Gobert set to soon win his fourth Defensive Player of the Year award, but the pairing of he and Towns amid Edwards' rise to superstardom has propelled to Minnesota to the top of the Western Conference as Wednesday's crucial battle for playoff seeding with the defending-champion Denver Nuggets awaits.

As currently constructed, the Timberwolves seem destined for at least two more seasons of top-tier title contention. No one would be surprised if they were playing in the Western Conference Finals come late May, either.

But Towns' mammoth contract extension kicking in next season complicates that rosy optimal future, and Minnesota has proven over the last few weeks it doesn't necessarily need the four-time All-Star to rack up wins in the regular season. Chris Finch's team is 12-5 since Towns went down with a meniscus injury in early March, sporting a +7.6 net rating that ranks sixth in the league over that timeframe, per NBA.com/stats. The Wolves' 115.2 offensive rating during that stretch is slightly better than their average number before Towns went down, too.

Towns is set to return before the end of the regular season. The truest test of his value to Minnesota would've come if he was forced to miss a portion of the postseason, pitting Reid—a Sixth Man of the Year frontrunner who's thrived while moonlighting as a starter during Towns' absence—as the Wolves' second-best all-around scorer behind Edwards and floor-spacing frontcourt partner for Gobert against elite competition.

There's still much to be gleaned about Minnesota's future prospects with or without Towns during this year's playoffs. Still, his return to the court in time for the postseason pressure cooker could make trading Towns in a salary dump far less palatable for whoever owns the team leading up to next season's trade deadline, especially if the Wolves win multiple rounds this spring.

Edwards' presence and ongoing ascent has changed everything for Minnesota. He's the untouchable building block this franchise has been searching for since Garnett left in 2008, and at 22, is still multiple years away from his prime. From that vantage point, taking a step back by moving Towns to cut costs and improve roster flexibility down the line doesn't seem like too tough a pill for the Timberwolves to swallow.

But fortunes change fast in the NBA. Perennial contention is never guaranteed. Will Minnesota really have the stomach to trade a Wolves lifer like Towns if he and Edwards lead them on a deep playoff run over the next couple months? Time isn't the only factor that will tell. Apparently, whether Rodriguez and Lore wrest control of the franchise from Taylor could decide that fraught dynamic, too.