In the high-stakes world of the NFL, every decision can carry substantial financial implications. This reality came into stark relief for the New York Jets with Aaron Rodgers's injury. His torn Achilles not only sidelined him but also exposed a significant oversight: the lack of an insurance addendum on his hefty contract.

This misstep cost the Jets dearly, both financially and strategically, marking a “tragic” mismanagement of resources, as noted by industry experts. According to a detailed report by Kalyn Kahler of ESPN, when the Jets renegotiated 40-year-old Rodgers’ contract following his trade, they omitted a crucial step that had been covered by his previous team, the Green Bay Packers—the inclusion of an insurance policy.

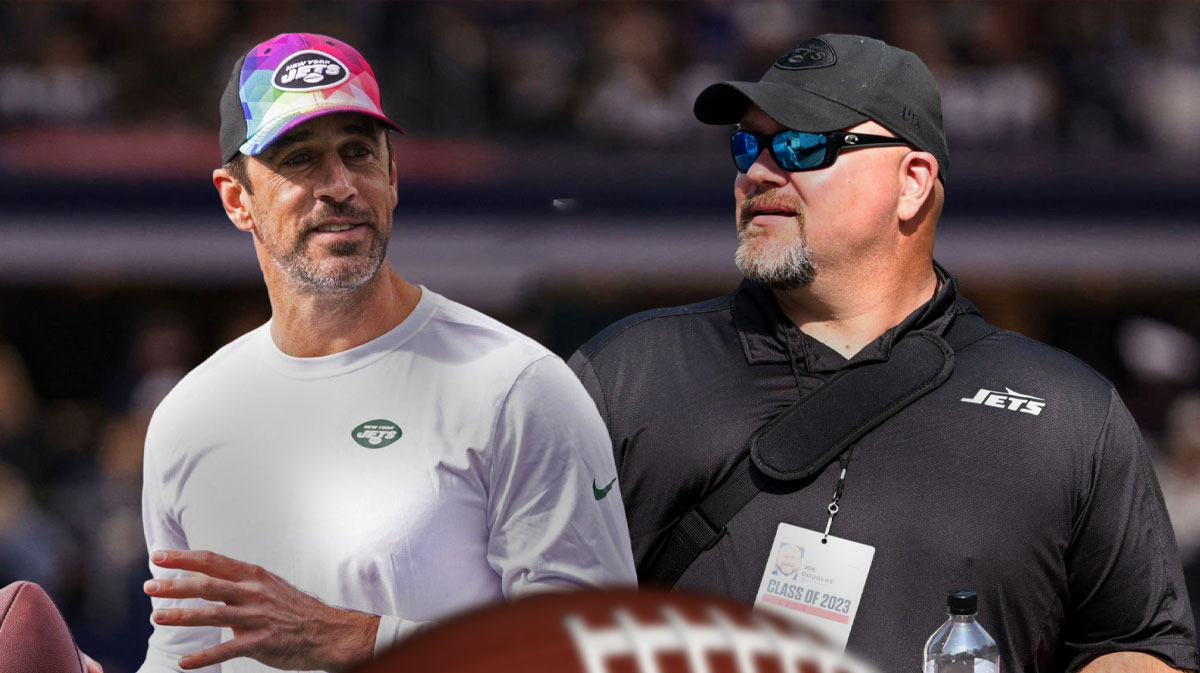

Aaron Rodgers' injury cost the Jets millions

This policy would have safeguarded a portion of the $37 million guaranteed to Rodgers, mitigating the financial blow from his inability to play due to injury.

“The Aaron Rodgers situation is a tragedy that should be understood,” Richard Buffum, a former NFL executive and current director at Excel Sports Management, commented on the oversight.

The repercussions of this decision extend beyond the immediate financial loss. The Jets missed out on what could have been substantial salary cap relief for the following season. This is because, under the Collective Bargaining Agreement, insurance proceeds are considered a “refund from the player,” thereby qualifying as a cap credit.

This aspect of NFL financial operations, often discussed in hushed tones, represents a strategic approach to managing cap space—a critical component in maintaining competitive balance within the league.

“Penny-wise, dollar foolish,” remarked a former NFL club executive in the ESPN article, criticizing the decision to forego insurance.

Reflecting a broader consensus that the move was short-sighted, particularly given the increasing frequency of high-profile injuries and the rising costs associated with securing star players.

Insurance in professional sports, particularly the NFL, is not just about mitigating the risks associated with player injuries. It’s about leveraging financial instruments to maintain flexibility under the salary cap, which can have long-term strategic benefits. Teams like the Packers and the Miami Dolphins have recognized this, insuring their quarterbacks upon signing new, significant contracts.

The failure by the Jets to secure an insurance policy for Rodgers speaks to a larger philosophical approach within the Jets organization, which according to the article, has not pursued such policies in at least a decade.

This approach can be influenced by numerous factors including the team’s financial philosophy and the owner’s willingness to invest in what Buffum describes as a “lose small, win big proposition.”

As the Jets navigate the aftermath of this oversight, the broader implications for the league are clear. With the increase in guaranteed money and the escalation of player salaries, the role of insurance as a strategic financial tool is becoming increasingly critical. Teams that effectively utilize these tools can protect themselves from unforeseen losses, turning potential financial disasters into manageable setbacks.

This situation also underscores the importance of comprehensive contract negotiations and the need for teams to consider all potential outcomes when signing or trading for high-value players. For the Jets, the lesson is costly, serving as a stark reminder of the complexities of NFL financial management and the consequences of oversight.